How Do You Spend Your Monthly Salary?

Ever wondered where your salary actually goes every month? You’re not alone. Most people know what they earn—but few can clearly explain where it all disappears by week three. Learning how to spend your monthly salary wisely isn’t about restriction—it’s about direction. If you feel like your money evaporates the moment it hits your account, this guide will help you rethink your spending habits with clarity and control. Let’s dive into a real-world, practical breakdown of how smart people allocate their income—and how you can too.

MONEY

PHILIP DEVILLE

5/1/20253 min read

How Do You Spend Your Monthly Salary?

Ever wondered where your salary actually goes every month? You’re not alone. Most people know what they earn—but few can clearly explain where it all disappears by week three. Learning how to spend your monthly salary wisely isn’t about restriction—it’s about direction.

If you feel like your money evaporates the moment it hits your account, this guide will help you rethink your spending habits with clarity and control.

Let’s dive into a real-world, practical breakdown of how smart people allocate their income—and how you can too.

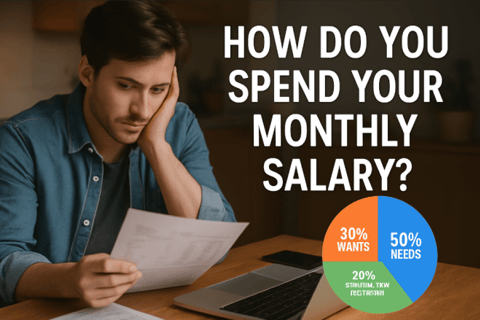

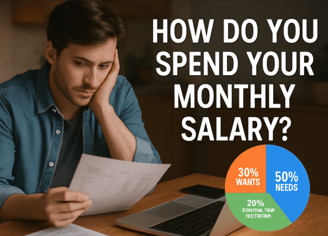

💡 The Ideal Monthly Salary Breakdown (50/30/20 Rule)

This proven budgeting method is simple and adaptable. Here’s how it works:

1. 50% – Needs

These are essentials. The must-pays that keep your life running:

Rent or mortgage

Utilities

Groceries

Transportation

Insurance

Minimum debt payments

If these take up more than half your salary, it might be time to reassess housing or car expenses.

✅ Target: $2,000 if you make $4,000/month

2. 30% – Wants

Yes, you’re allowed to enjoy your money. This category includes:

Dining out

Streaming services

New clothes

Hobbies

Vacations

That daily latte (yes, it counts!)

Wants often creep higher than we realize. Tracking these can help you identify spending leaks.

✅ Target: $1,200 on a $4,000 salary

3. 20% – Savings & Debt Repayment

This is your future fund. It covers:

Emergency savings

Retirement (401k, IRA)

Extra debt payments (credit card, student loans)

Investing

Most people skip this part—and regret it later. Automate transfers on payday to avoid temptation.

✅ Target: $800/month on a $4,000 salary

💰 What Real People Spend On (Real-Life Examples)

🧑💻 Sarah, 29, Tech Support ($3,500/month)

Rent: $1,200

Groceries: $400

Subscriptions: $65

Fun: $300

Student loans: $500

Savings: $200

Misc/Buffer: $83

👨🔧 James, 42, Mechanic ($4,800/month)

Mortgage: $1,400

Car payment + gas: $600

Groceries: $600

Childcare: $500

Fun/Travel: $400

Roth IRA: $300

Emergency fund: $300

Leftover: $700 (usually spent on home upgrades or kids’ activities)

These examples show how different lives shape different spending habits. The goal isn’t to copy—it’s to create a system that works for you.

🔍 Smart Habits to Track and Improve Spending

Use apps like YNAB, Mint, or Spendee to track every dollar.

Label your bank transfers. Example: “Vacation Fund – June” or “Car Down Payment.”

Review last month’s statement. Circle non-essential expenses and ask: “Was this worth it?”

✅ Short Q&A: Monthly Salary Spending

Q: Is it better to pay off debt or save first?

A: Do both—pay minimums on all debts while building an emergency fund. Then, tackle high-interest debt aggressively.

Q: What percentage should I invest monthly?

A: Aim for at least 15% toward retirement if possible. Even 5–10% is better than nothing.

Q: I live paycheck to paycheck. What’s the first thing to change?

A: Track every dollar for 30 days. Awareness alone can reveal hidden spending that can be redirected to savings or debt relief.

✨ My Final Conclusion:

Your salary is your tool—not your trap. Whether you earn $2,000 or $10,000 a month, how you spend it shapes your life more than how much you make.

So ask yourself:

Where is your money actually going—and is it building the life you want?

If this helped you, share it or comment:

What’s the one thing you wish you spent less—or more—of your salary on?

✨Remember, We are looking for Happiness. You can have a lot of Money in your bank and Be Miserable... So is it GOOD to have Money in the Bank? YES! Does it DO IT ALL? Of Course NOT!

FINDING Spirituality is Essential. Be Kind with People and You will SEE that YOUR LIFE IS RICH and FULL...

⚠️ Disclaimer:

This article is for informational purposes only and is not medical advice. Fasting and any diet changes may affect individuals differently. Always consult with a qualified healthcare professional before starting any fasting plan, diet, or weight loss program, especially if you have pre-existing health conditions or take medications. Results vary, and this content is based on personal experience and research. Your health and safety come first! 🚀🔥

We are affiliates. It means that we might receive a commission if you ever buy a product on our website, with no-extra cost for You of course. Thank You very much!

(Some parts of this article was written with the help of AI to provide the most effective and well-researched tips.)

Written by PHILIP DEVILLE

Empowerment

Transform your mindset for lasting weight loss.

Support

Journey

contact@mindfit.blog

© 2024. All rights reserved.

Disclaimer: We are not doctors. You should see one before starting any diet or routine in your life, especially if you are under conditions! Plus, We are affiliates. Which mean we may receive a commission if You ever purchase a product on our site, with no extra-cost for You of course! Thank You Very Much!